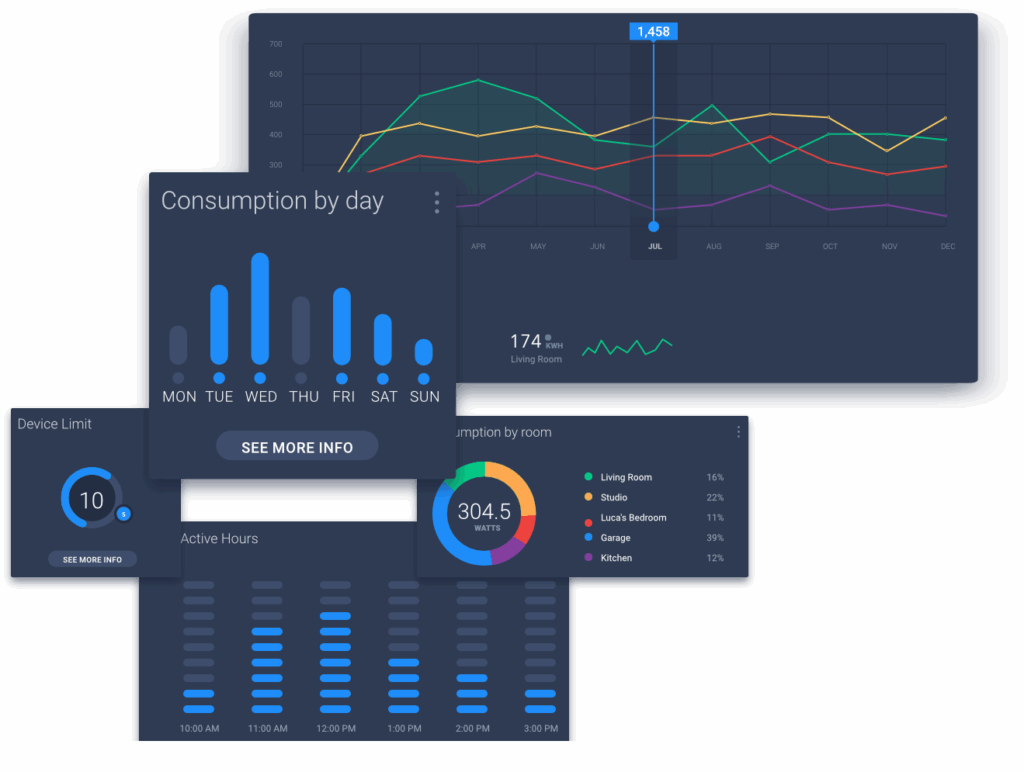

The Ultimate Smart Home Dashboard.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

Feature Packed

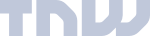

Dashboards & Analytics

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec massa leo, rhoncus imperdiet vehicula sit amet, porta sed risus. Pellentesque dignissim finibus imperdiet.

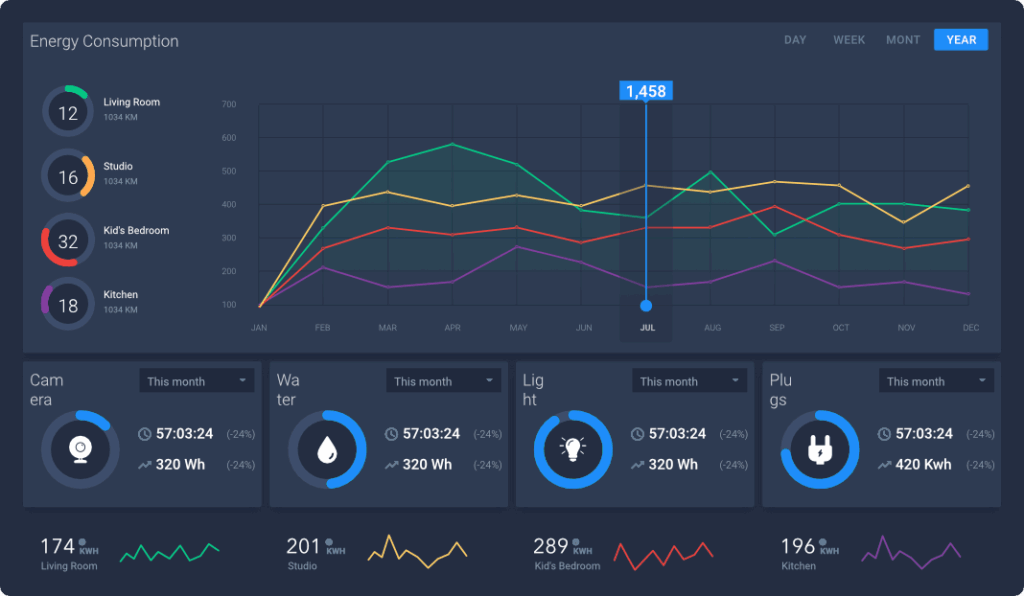

Custom Layouts

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec massa leo, rhoncus imperdiet vehicula sit amet, porta sed risus. Pellentesque dignissim finibus imperdiet.

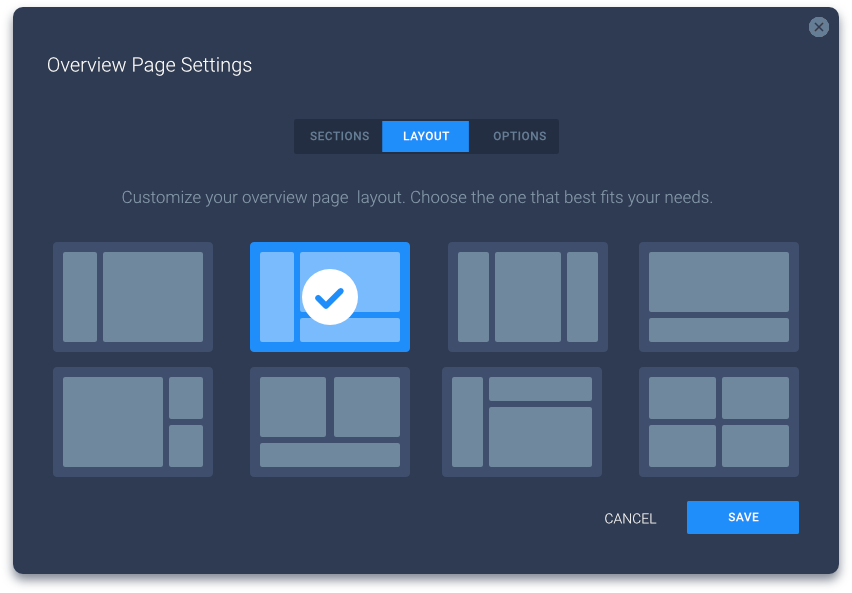

Simple Device Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec massa leo, rhoncus imperdiet vehicula sit amet, porta sed risus. Pellentesque dignissim finibus imperdiet.